Central bank policymakers trimmed interest rates by 50 basis points, marking its first cut in four years.

- The Economy is strong overall and the Labor market has cooled

- Inflation has eased from a high of 7% to 2.2% (their goal is 2%)

- They announced the lowering of the Fed Rates by .50% (from 5.5% down to 5.0%)

- Housing fell in the 2nd quarter after a strong rise in the 1st quarter

- Unemployment has moved up, although still “low” at 4.2% (projected to be 4.4% by end of year)

- Last year was in the mid 3% range

- Their Goal is for maximum employment and stable prices

- No preset course, they are making decisions meeting by meeting…no “set plan” for more rate cuts, but will continue to “watch all the data”

Regarding the Housing market

- People are not wanting to sell due to their current low rates obtained during the pandemic

- As rates come down, people will ease into the idea of giving up the low rate

- Housing issue is challenging due to low inventory at the moment

Regarding Mortgage Rates

- Most Lenders have already dropped rates in anticipation of fed rate cuts

- Rates dropping further will depend on the economy, but they expect the process to take time during their “recalibration” to bring stability

Overall, they are expecting 2025 to be a good year!

For more info on the Fed Rate history, see this link:

https://tradingeconomics.com/united-states/interest-rate

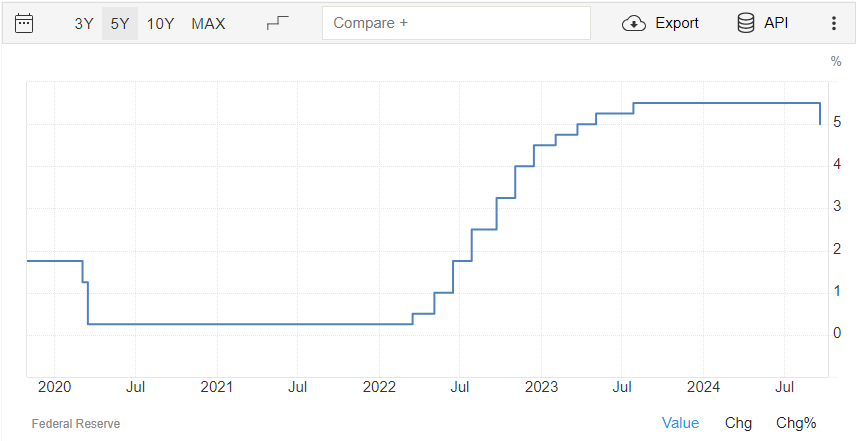

Here is a Graph looking back at the last 5 years.

You can see the Fed rate was down to .25% during the pandemic, but prior to that, we were under 2.00%.

From March 2022, we started climbing where it peaked at 5.25% in July of 2023 and remained until Today’s announced rate cut.

If you’re interested in buying a home and take advantage of the lowering of mortgage rates, contact one of our professional real estate agents.